Contact me for more details and to book a 15 min consultation, visit RLWRealEstate.com or call me at 817-791-0631.

The Long-Term Benefit of Homeownership

Today’s cooling housing market, the rise in mortgage rates, and mounting economic concerns have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to factor the long-term benefits of homeownership into your decision.

Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how you gain equity and wealth as home values grow with time.

The National Association of Realtors (NAR) explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

Here’s a look at how just the home price appreciation piece can really add up over the years.

Home Price Growth Over Time

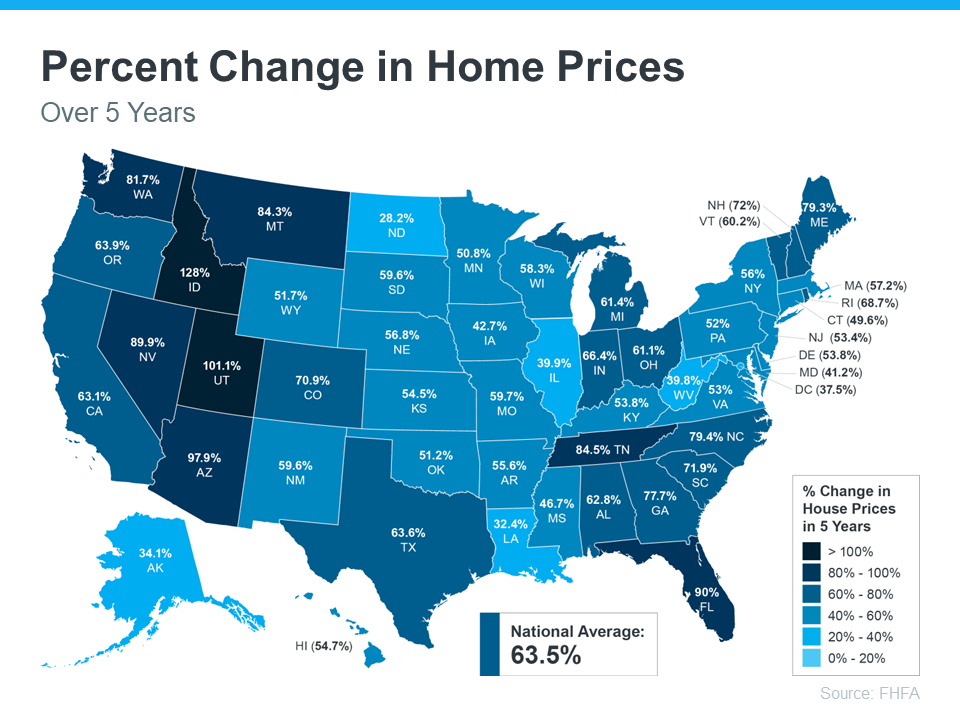

Even though home price appreciation has moderated this year, home values have still increased significantly in recent years. The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy those gains have been over the last five years.

If you look at the percent change in home prices, you can see home prices grew on average by almost 64% nationwide over that period.

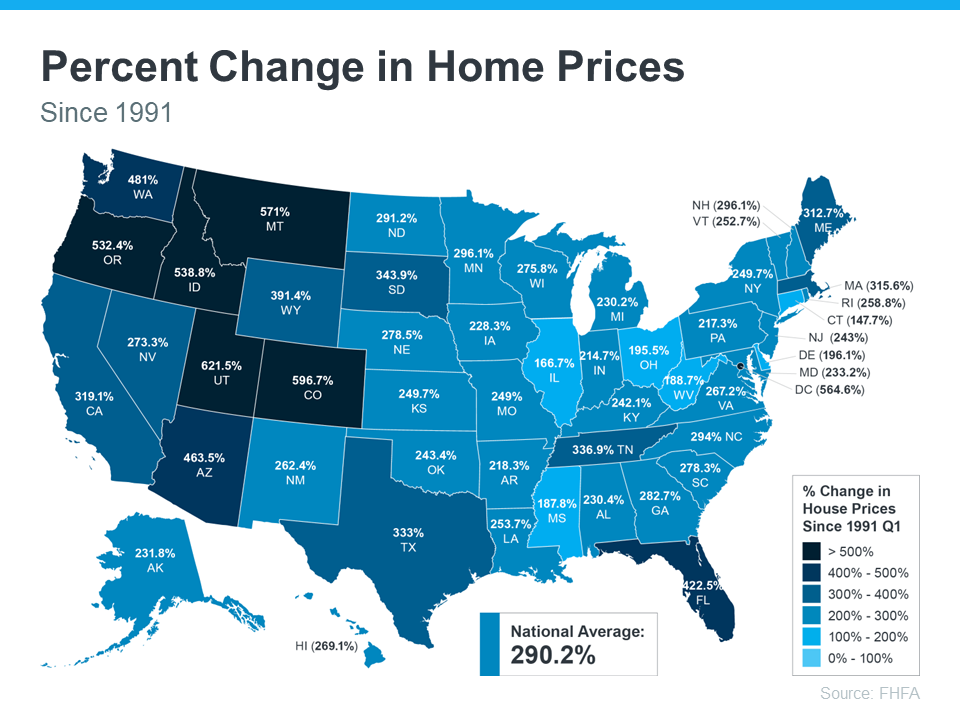

That means a home’s value can increase substantially in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains you stand to make become even clearer (see map below):

The second map shows, nationwide, home prices appreciated by an average of over 290% over roughly a thirty-year span.

While home price growth varies by state and local area, the nationwide average tells you the typical homeowner who bought a house thirty years ago saw their home almost triple in value over that time. This is why homeowners who bought their homes years ago are still happy with their decision.

Even if home price appreciation eases as the market cools this year, experts say home prices are still expected to appreciate nationally in 2023. That means, in most markets, your home should grow in value over the next year even if the pace is slower than it was during the peak market frenzy when prices skyrocketed.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and fight annual lease hikes for no long-term financial benefit? Instead, consider buying a home. It’s an investment in your future that could set you up for long-term gains.

Bottom Line

Don’t let the shifting market delay your dreams. Data shows home values typically appreciate over time, and that gives your net worth a nice boost. If you’re ready to start your journey to homeownership, let’s connect today.

Two Questions Every Homebuyer Should Ask Themselves Right Now

Rising interest rates have begun to slow an overheated housing market as monthly mortgage payments have risen dramatically since the beginning of the year. This is leaving some people who want to purchase a home priced out of the market and others wondering if now is the time to buy one. But this rise in borrowing cost shows no signs of letting up soon.

Economic uncertainty and the volatility of the financial markets are causing mortgage rates to rise. George Ratiu, Senior Economist and Manager of Economic Research at realtor.com, says this:

“While even two months ago rates above 7% may have seemed unthinkable, at the current pace, we can expect rates to surpass that level in the next three months.”

So, is now the right time to buy a home? Anyone thinking about buying a home today should ask themselves two questions:

1. Where Do I Think Home Prices Are Heading?

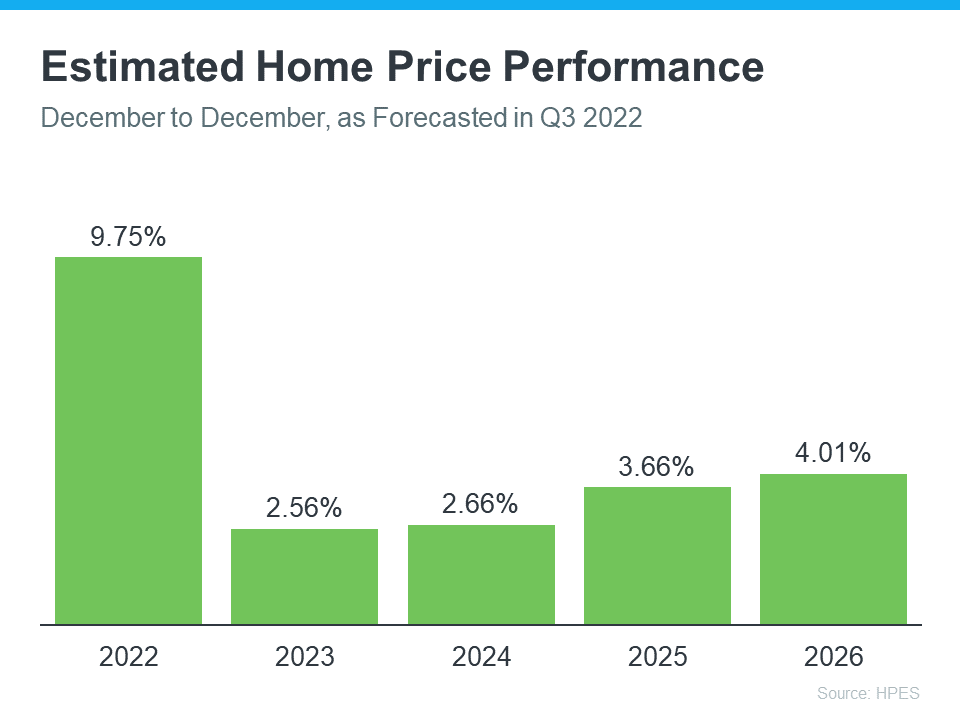

There are two places to turn to answer this question. First is the consensus of what experts are saying. If you look at what experts are projecting for home prices in 2023, they’re forecasting home price appreciation around 2%. While it’s true some are calling for depreciation, most are calling for appreciation in home values over the next year.

The second spot to turn to for information is the Home Price Expectation Survey from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists. According to the latest release, the experts surveyed are also calling for home price appreciation for the next several years (see graph below):

2. Where Do I Think Interest Rates Are Heading?

Like mentioned above, Ratiu sees mortgage rates rising over the next several months. Another expert agrees. Mark Fleming, Chief Economist at First American, says:

“While mortgage rates are expected to continue to drift higher over the coming months, much of the rapid increase in rates is likely behind us.”

The instability in the world and higher inflation are driving this volatile market, resulting in higher borrowing rates for those looking to buy homes.

Bottom Line

If you’re thinking about buying a home, asking yourself about home prices and mortgage rates will help you make a powerful and confident decision. Experts see both prices and rates rising in the future. The alternative is to rent, but rents are also increasing. That may mean buying a home makes more sense than renting.

The 10 Mistakes Buyers Make When Purchasing a Home

Purchasing a home is one of the biggest financial decisions you will make. It is very important to be informed before and stay informed during the process—and make sure you have a good REALTOR® at your side every step of the way.

Here is a list of the 10 most commonly made mistakes buyers make when purchasing a home (as documented by Brian Buffini)

1. Making an offer on a home without being prequalified. Pre-qualification will make your life easier—so take the time to speak with a lender. The lender’s specific questions in regard to income, debt, etc., will help you determine the price range you can afford.

2. Not having a home inspection. Trying to save money today can end up costing you tomorrow. A qualified home inspector will detect issues that many buyers might overlook.

3. Limiting your search to open houses, ads or the Internet. Many homes listed in magazines or on the Internet have already been sold. Your best course of action is to contact a REALTOR®. They have up-to-date information that is unavailable to the general public and are the best resource to help you find the home you want.

4. Choosing a REALTOR® who is not committed to forming a strong business relationship with you. Making a connection with the right REALTOR® is crucial. Choose a professional who is dedicated to serving your needs—before, during and after the sale.

5. Thinking there is only one perfect house out there. Buying a home is a process of elimination, not selection. New properties arrive on the market daily, so be open to all possibilities. Ask your REALTOR® for a comparative market analysis, which compares similar homes that have recently sold, or are still for sale.

6. Not considering long-term needs. It is important to think ahead. Will the home suit your needs 3-5 years from now?

7. Not examining insurance issues. Purchase adequate insurance. Advice from an insurance agent can provide you with answers to any concerns you may have.

8. Not buying a home protection plan. This is essentially a mini insurance policy that usually covers basic repairs you may encounter and can be purchased for a nominal fee. As an item of value, I provide my clients a Home Warranty from Super Home Warranty company ($459 value)

9. Not knowing total costs involved. Early in the buying process, ask your REALTOR® or lender for an estimate of closing costs. Title company and attorney fees should be considered. Pre-pay responsibilities such as Homeowner Association fees and insurance must also be taken into account. Remember to examine your settlement statement prior to closing.

10. Not following through on due diligence. Buyers should make a list of any concerns they have relating to issues such as crime rates, schools, power lines, neighbors, environmental conditions, etc. Ask the important questions before you make an offer on a home. Be diligent so that you can have confidence in your purchase.

Bonus Tip: Being Unrepresented With New Construction. New build salespeople are protecting the interest of their builder, your REALTOR® is protecting your interest, with negotiations, recommended inspections, etc.

If you are in the market to buy a home, I help DFW residents alleviate the stress of buying for the best possible price in the least amount of time.

Will My House Still Sell in Today’s Market?

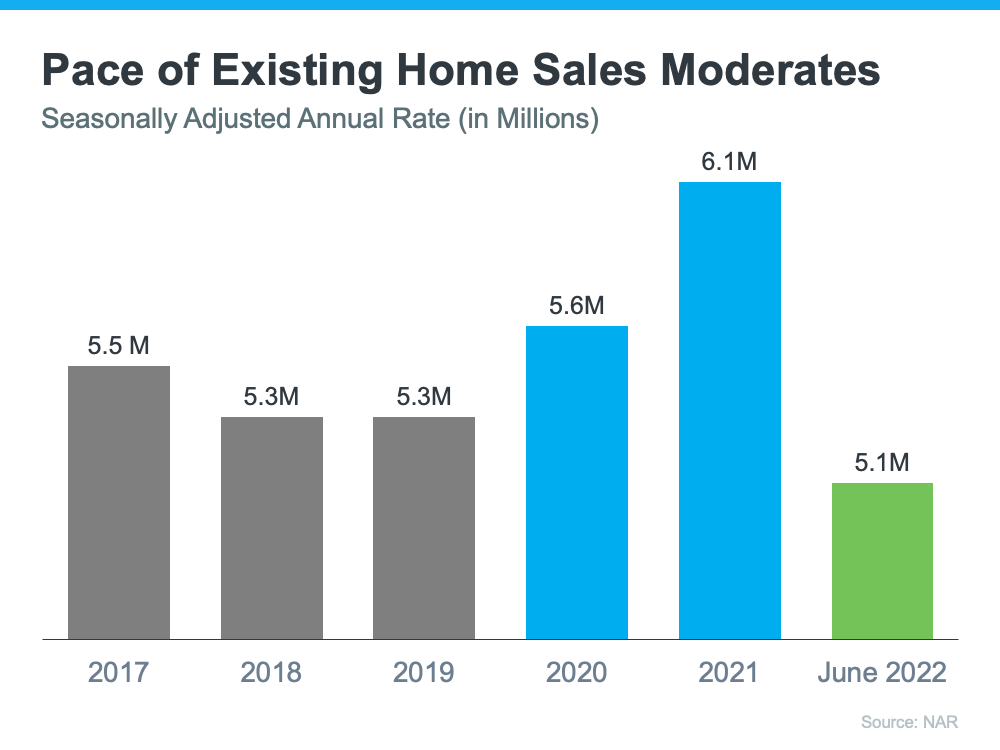

If recent headlines about the housing market cooling and buyer demand moderating have you worried you’ve missed your chance to sell, here’s what you need to know. Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the past two years.

Buyer Demand Then and Now

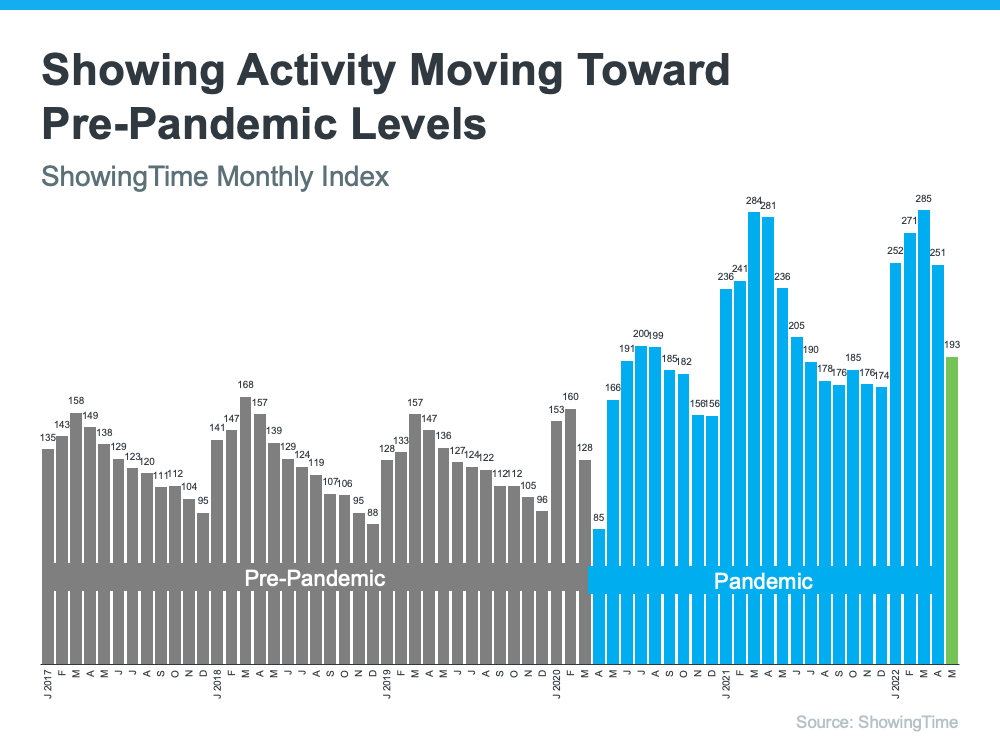

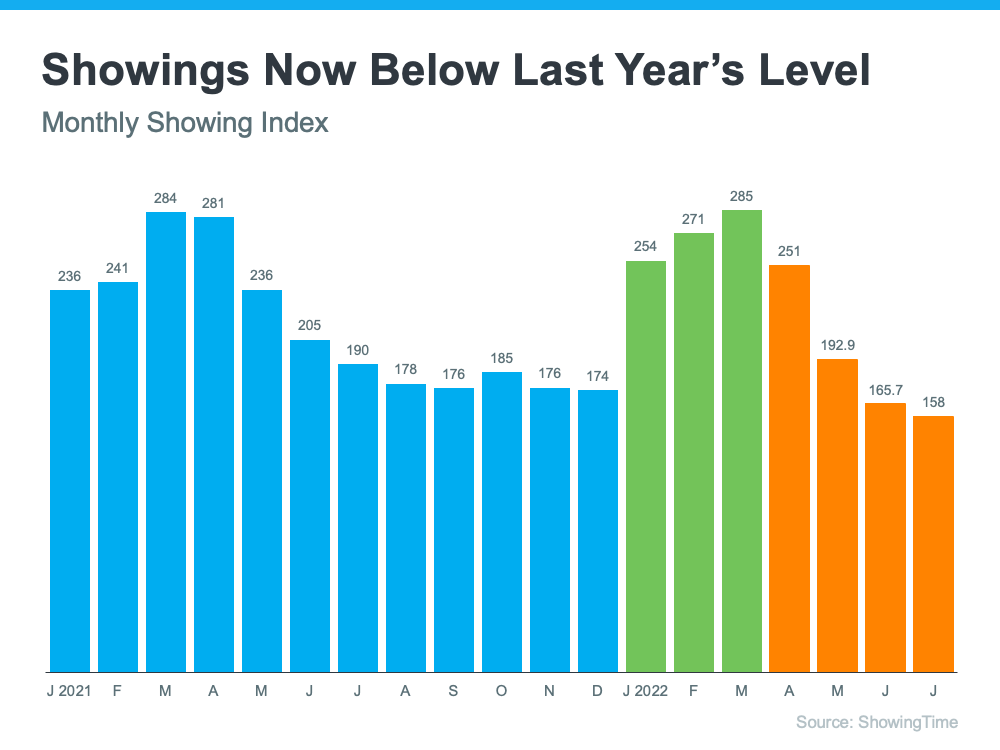

During the pandemic, mortgage rates hit record lows, and that spurred a significant rise in buyer demand. This year, as rates increased due to factors like rising inflation, buyer demand pulled back or softened as a result. The latest data from ShowingTime confirms this trend (see graph below):

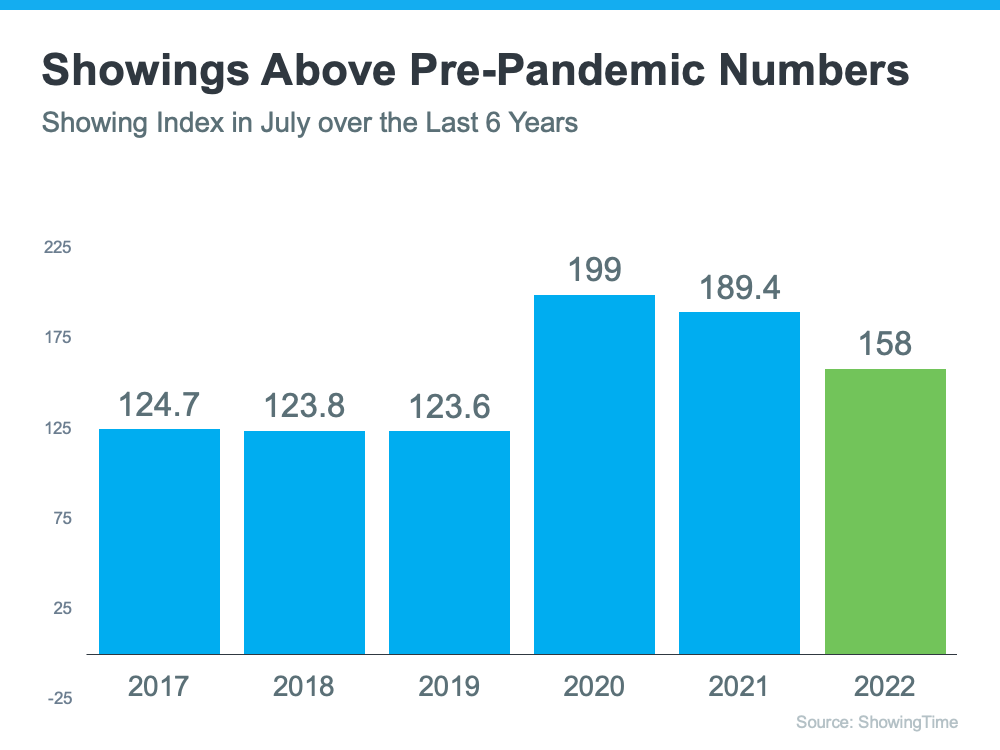

The orange bars in the graph above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since mortgage rates started to rise. But context is important. To get the full picture of where today’s demand stands, let’s look at the July data for the past six years (see graph below):

This second visual makes it clear that, while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. That goes to show there’s still demand if you sell your house today.

What That Means for You When You Sell

The key to selling in a changing market is understanding where the housing market is now. It’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed.

While things have cooled a tad, it’s still a sellers’ market. If you work with me your trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. According to a recent survey from realtor.com, 92% of homeowners who sold in August reported being satisfied with the outcome of their sale.

Bottom Line

Buyer demand hasn’t disappeared, it’s just moderated this year. If you’re ready to sell your house today, let’s connect so you have expert insights on how the market has shifted and how to plan accordingly for your sale.

Expert Forecasts on Mortgage Rates

If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues to slow?

As you think about your homeownership goals and decide if now’s the time to make your move, the best place to turn to for that information is the professionals. Here’s a summary of the latest mortgage rate forecasts from housing market experts.

Experts Project Mortgage Rates Will Stabilize

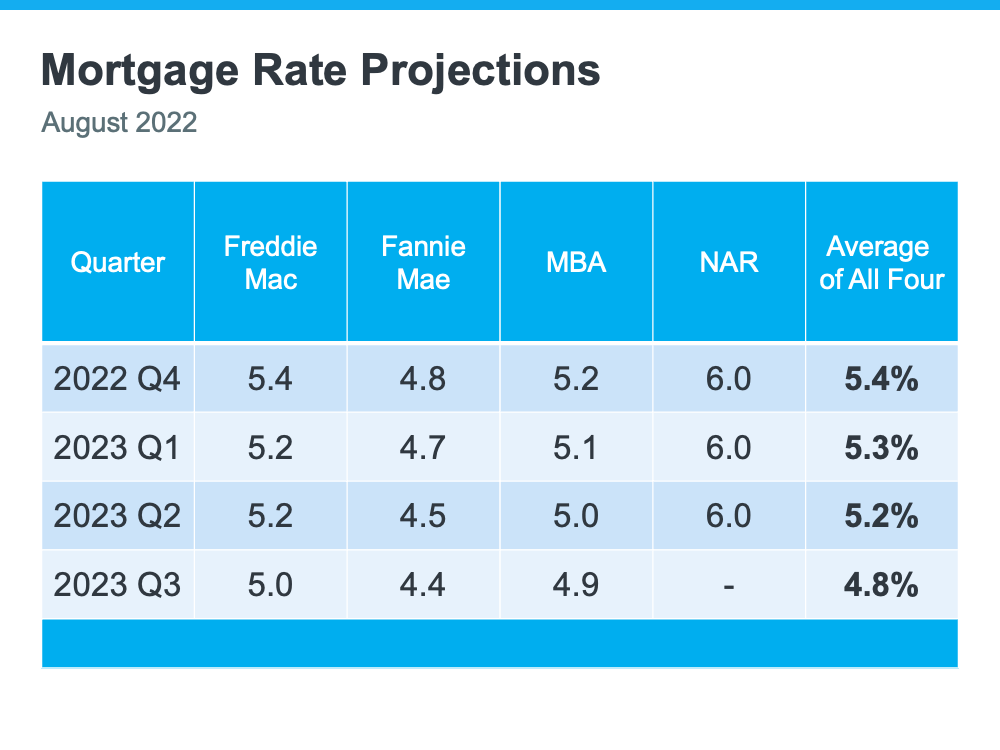

While mortgage rates continue to fluctuate due to ongoing inflationary pressures and economic uncertainty, experts project they’ll start to stabilize in the months ahead. According to the latest projections, mortgage rates are expected to hover in the low to mid 5% range initially, and then potentially dip into the high 4% range by later next year (see chart below):

That could bring you some welcome relief. So far this year, mortgage rates have climbed over two percentage points due to the Federal Reserve’s response to inflation, and that’s made it more expensive to buy a home. And wondering if the rise in rates will continue is keeping some prospective buyers on the sidelines.

But now that experts say mortgage rates should stabilize, this gives you a bit more certainty about what they think the future holds, and that may help you feel more confident about your decision to buy a home.

Bottom Line

Whether you’re looking to buy your first home, move up to a larger home, or even downsize, you need to know what’s happening in the housing market so you can make the most informed decision possible. Let’s connect to discuss your goals and determine the best plan for your move.

Should I Sell My House This Year?

There’s no denying the housing market is undergoing a shift this season as buyer demand slows and the number of homes for sale grows. But that shift actually gives you some unique benefits when you sell. Here’s a look at the key opportunities you have if you list your house this fall.

Opportunity #1: You Have More Options for Your Move

One of the biggest stories today is the growing supply of homes for sale. Housing inventory has been increasing since the start of the year, primarily because higher mortgage rates helped cool off the peak frenzy of buyer demand. But what you may not realize is, that actually could benefit you.

If you’re selling your house to make a move, it means you’ll have more options for your own home search. That gives you an even better chance to find a home that checks all of your boxes. So, if you’ve put off selling because you were worried about being able to find somewhere to go, know your options have improved.

Opportunity #2: The Number of Homes on the Market Is Still Low

Just remember, while data shows the number of homes for sale has increased this year, housing supply is still firmly in sellers’ market territory. To be in a balanced market where there are enough homes available to meet the pace of buyer demand, there would need to be a six months’ supply of homes. According to the latest report from the National Association of Realtors (NAR), in July, there was only a 3.3 months’ supply.

While you’ll have more options for your own home search, inventory is still low, and that means your home will still be in demand if you price it right. That’s why the most recent data from NAR also shows the average home sold in July still saw multiple offers and sold in as little as 14 days.

Opportunity #3: Your Equity Has Grown by Record Amounts

The home price appreciation the market saw over the past few years has likely given your equity (and your net worth) a considerable boost. Danielle Hale, Chief Economist at realtor.com, explains:

“Home owners trying to decide if now is the time to list their home for sale are still in a good position in many markets across the country as a decade of rising home prices gives them a substantial equity cushion . . .”

If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help. It may be just what you need to cover a large portion (if not all) of the down payment on your next home.

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

For All Your Home Needs

Hello Friend… as your resource for all things home-related, I’m thrilled to deliver a real estate experience you won’t find anywhere else. From the agent to the title company and mortgage lender to insurance, property management and vendor connections, I can provide a ONE TEAM approach to service. I’m here to be your one-stop-shop for all your home-related needs – for a lifetime. Text me to schedule a time to visit!

A Real Estate Professional Helps You Separate Fact from Fiction

If you’re following the news, chances are you’ve seen or heard some headlines about the housing market that don’t give the full picture. The real estate market is shifting, and when that happens, it can be hard to separate fact from fiction. That’s where a trusted real estate professional comes in. They can help debunk the headlines so you can really understand today’s market and what it means for you.

Here are three common housing market myths you might be hearing, along with the expert analysis that provides better context.

Myth 1: Home Prices Are Going To Fall

One piece of fiction many buyers may have seen or heard is that home prices are going to crash. That’s because headlines often use similar, but different, terms to describe what’s happening with prices. A few you might be seeing right now include:

- Appreciation, or an increase in home prices.

- Depreciation, or a decrease in home prices.

- And deceleration, which is an increase in home prices, but at a slower pace.

The fact is, experts aren’t calling for a decrease in prices. Instead, they forecast appreciation will continue, just at a decelerated pace. That means home prices will continue rising and won’t fall. Selma Hepp, Deputy Chief Economist at CoreLogic, explains:

“. . . higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

Myth 2: The Housing Market Is in a Correction

Another common myth is that the housing market is in a correction. Again, that’s not the case. Here’s why. According to Forbes:

“A correction is a sustained decline in the value of a market index or the price of an individual asset. A correction is generally agreed to be a 10% to 20% drop in value from a recent peak.”

As mentioned above, home prices are still appreciating, and experts project that will continue, just at a slower pace. That means the housing market isn’t in a correction because prices aren’t falling. It’s just moderating compared to the last two years, which were record-breaking in nearly every way.

Myth 3: The Housing Market Is Going To Crash

Some headlines are generating worry that the housing market is a bubble ready to burst. But experts say today is nothing like 2008. One of the reasons why is because lending standards are very different today. Logan Mohtashami, Lead Analyst for HousingWire, explains:

“As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. This typically happens in a recession, however, the notion that credit lending in America will collapse as it did from 2005 to 2008 couldn’t be more incorrect, as we haven’t had a credit boom in the period between 2008-2022.”

During the last housing bubble, it was much easier to get a mortgage than it is today. Since then, lending standards have tightened significantly, and purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash.

Bottom Line

No matter what you’re hearing about the housing market, let’s connect. That way, you’ll have a knowledgeable authority on your side that knows the ins and outs of the market, including current trends, historical context, and so much more.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link