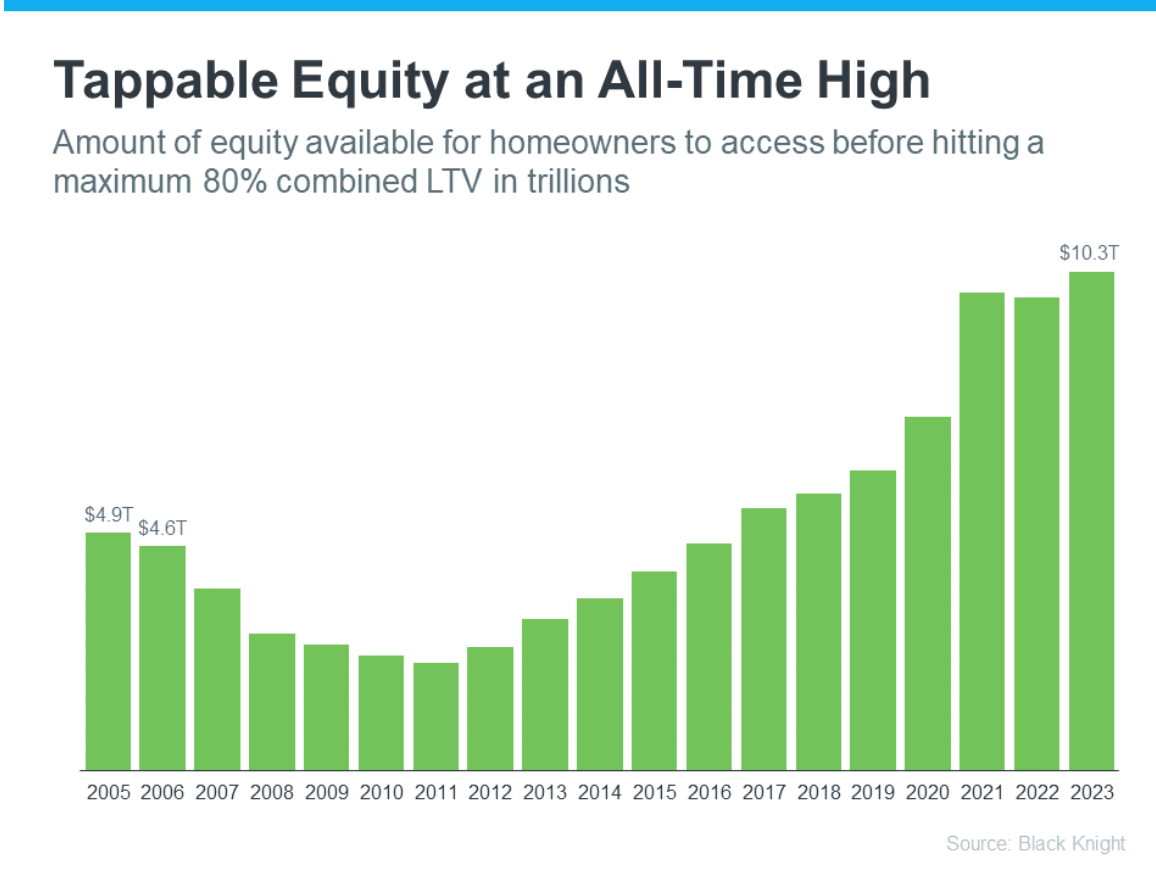

When you’re planning your next home purchase, one powerful financial tool you may not have considered is your current home equity. Whether you’re downsizing, relocating, or upgrading, tapping into your home equity could help you buy your next home with cash—simplifying the process and potentially saving you thousands in the long run. Here’s how.

Understanding Home Equity and Its Potential

Home equity is the difference between the current market value of your home and the amount you still owe on your mortgage. Over the years, your home equity builds as you make payments and as the market appreciates.

For example:

- If your home is worth $400,000 and you owe $150,000, you have $250,000 in equity.

This equity can be unlocked and used as a significant asset toward your next home purchase.

Why Buying with Cash Is Beneficial

When you use your home equity to buy your next home outright with cash, several benefits come into play:

- Increased Negotiating Power: Cash offers are more appealing to sellers, often giving you leverage to negotiate a better price.

- No Monthly Mortgage Payments: Eliminating a mortgage means more cash flow for you to allocate toward other goals.

- Faster Closing Process: Cash transactions typically close faster since you’re skipping the mortgage approval process.

- More Competitive in a Tight Market: In a competitive real estate market, a cash offer can set you apart from other buyers.

How to Leverage Home Equity to Buy Your Next Home

Here are a few ways you can tap into your home equity:

- Sell Your Current Home First:

The most straightforward option is to sell your current home and use the proceeds to purchase your next home. With guidance from a real estate expert, you can time your sale and purchase to minimize the transition period. - Bridge Loans:

If you’re not ready to sell before buying, you can consider a bridge loan. This type of short-term loan helps “bridge” the gap by providing the cash you need until your current home sells. - HELOC (Home Equity Line of Credit):

A HELOC allows you to borrow against your home equity and access those funds when needed. However, this approach typically works best if you plan to keep your existing home or if your financial situation allows you to manage both.

The Importance of Partnering with a Real Estate Professional

Making a move that involves leveraging your home equity can be complex. You’ll want a trusted real estate professional by your side to guide you through pricing, market conditions, and financing options.

As a local real estate expert with Century 21 Judge Fite Company, I am here to make your buying and selling experience as seamless as possible. I will provide you with a detailed market analysis and help you navigate every step of the process—from listing your current home to finding the perfect new one.

Ready to Unlock the Power of Your Home Equity?

If you’ve been considering your next move, there’s no better time to explore how your home equity can help you achieve your real estate goals. Whether you’re looking to downsize, move to a new area, or simply upgrade, I’m here to guide you with expert advice and personalized service.

Contact me, Robert L. Wagner, REALTOR®️ with Century 21 Judge Fite Company, at 817-791-0631 to schedule a free consultation. Let’s make your home transition a smooth and rewarding journey!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link